Mastering Discounted Cash Flow (DCF): A Guide to Valuing Businesses with Uncertain Futures

When it comes to evaluating a business’s value, particularly those with unpredictable cash flows, the Discounted Cash Flow (DCF) method stands out as a preferred tool among financial analysts and investors. This method not only accounts for the current state of a company but also forecasts its future financial health. In this blog post, we will explore the DCF method in depth, providing an easy-to-understand example to illustrate how it works and why it’s such a powerful tool for valuation.

What is Discounted Cash Flow (DCF)?

Discounted Cash Flow (DCF) is a valuation technique used to estimate the attractiveness of an investment opportunity. DCF analysis uses future free cash flow projections and discounts them (hence the name), to arrive at a present value estimate, which is used to evaluate the potential for investment. If the value arrived at through DCF analysis is higher than the current cost of the investment, this suggests a good opportunity.

How Does DCF Work?

The core of the DCF model involves three key components:

Forecasting Cash Flows: This is where you project the company’s expected cash flows over a certain period, typically 5 to 10 years. These projections should include all cash inflows and outflows that are expected to occur.

Selecting a Discount Rate: This rate is crucial as it will be used to ‘discount’ the future cash flows back to their present value. This rate typically reflects the cost of capital or the risk-free rate plus a risk premium.

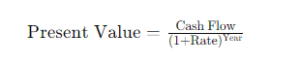

Calculating Present Value: Using the discount rate, the future cash flows are discounted back to the present day, which provides a value that represents the total value of the company.

Example of DCF in Action

Let’s consider a hypothetical company, Tech Innovations Inc., which is looking to expand its operations. Analysts predict that the company will generate the following cash flows over the next five years:

- Year 1: $150,000

- Year 2: $180,000

- Year 3: $210,000

- Year 4: $240,000

- Year 5: $270,000

Assuming a discount rate of 10%, let’s calculate the present value of these cash flows.

Calculation:

- Year 1 PV = $150,000 / (1.1)^1 = $136,363

- Year 2 PV = $180,000 / (1.1)^2 = $148,760

- Year 3 PV = $210,000 / (1.1)^3 = $158,110

- Year 4 PV = $240,000 / (1.1)^4 = $165,289

- Year 5 PV = $270,000 / (1.1)^5 = $170,576

The total present value of these cash flows is $779,098.

Why Use DCF?

- Future-Oriented: DCF is one of the few methods that directly factor in the future outlook of a company, making it valuable for businesses with significant expected growth or fluctuations.

- Detail-Oriented: It requires detailed forecasts of cash flows, making it thorough and comprehensive.

- Flexibility: It can be adjusted for various scenarios to see how changes in conditions might affect a company’s valuation.

Limitations of DCF

- Complexity: Calculating DCF can be complex and requires accurate estimations of future cash flows, which can be challenging.

- Sensitivity to Inputs: DCF is highly sensitive to changes in inputs, especially the discount rate and future cash flows.

DCF is a powerful tool in the financial analyst’s toolkit, especially useful for valuing companies with uncertain or variable future cash flows. Understanding and using this method effectively can provide deep insights into the potential investment returns of a company. Remember, while DCF is a strong method, it’s always good practice to use it in conjunction with other valuation techniques to get a comprehensive view of a company’s worth.